Evolution shares tumble amid weak report: analysts expected more

Evolution shares fell by 19.32% after the publication of the Q1 2025 financial report, which failed to meet analysts’ expectations.

Investor disappointment: results below forecast

Financial results of the Swedish Live Casino developer Evolution for the first quarter of 2025 came in weaker than Bloomberg’s forecasts.

Analysts expected EBITDA of €364 million, but the company reported €342 million, which is 1.1% lower than last year’s figures.

The Bloomberg forecast was based on a consensus of 11 analysts:

| Metric | Expectations (Q1 2025) | Actual Result | Last Year (Q1 2024) |

|---|---|---|---|

| Revenue | €540 million | €520.9 million | €501 million |

| EBITDA | €364 million | €342 million | €346 million |

Growth slows down

Despite positive dynamics compared to last year, revenue growth has slowed. In Q1 2025, revenue grew by 3.9% (compared to 12.3% in Q4 2024). At the same time:

- Revenue from Live Casino increased by 4%

- Revenue from RNG games — by 3%

EBITDA margin stood at 65.6%, while a year ago it was 69%.

Reasons for profit decline

Evolution CEO Martin Carlesund attributed the profit decline to several factors:

- currency fluctuations;

- additional costs for combating cyber threats in Asia;

- new regulatory restrictions in Europe;

- limited resources due to strikes at the Georgian studio.

Despite these challenges, Carlesund confirmed the annual EBITDA margin forecast in the range of 66–68%.

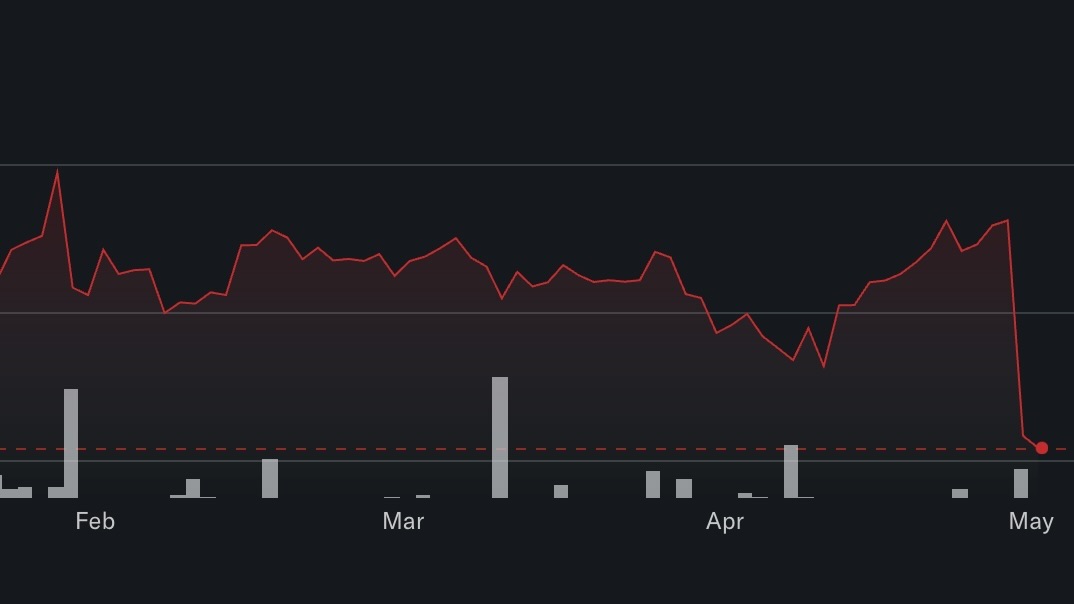

Evolution shares plunge sharply

Following the report’s release, Evolution shares dropped by 19.32% and are trading at €61.7 per share. This is the worst market reaction to the company’s earnings in recent quarters.

How shares reacted to previous reports

Below is a table showing the dynamics of Evolution’s stock on earnings release days over recent quarters:

| Period | Report Date | Stock Price Change, % |

|---|---|---|

| Q4 2024 | 30.01.2025 | – |

| Q3 2024 | 24.10.2024 | +14.9% |

| Q2 2024 | 19.07.2024 | -8.3% |

| Q1 2024 | 24.04.2024 | -5.4% |

| Q4 2023 | 01.02.2024 | +6.1% |

| Q3 2023 | 26.10.2023 | -6.1% |

| Q2 2023 | 21.07.2023 | +0.1% |

| Q1 2023 | 27.04.2023 | -1.3% |

Expectations for Q2 2025

The company forecasts a challenging second quarter but is maintaining its annual EBITDA margin target.

The market will closely monitor the results and any potential recovery following the sharp share price decline.