Venezuela, Mexico, and Argentina Lead the Growth of the iGaming Market in Latin America

Latin America is becoming an increasingly attractive region for iGaming operators. Year after year, the countries in the region demonstrate significant growth in the online gaming sector. According to the latest research by Blask, Venezuela, Mexico, and Argentina have emerged as the leaders in market growth in 2024.

Venezuela: The Unexpected Leader

Venezuela showed the most impressive growth among the countries in the region. According to Blask, the market index grew by 94.75% in 2024, reaching 29 million. This surge resulted from economic and political difficulties that impacted traditional land-based casinos but spurred growth in online gaming. Operators such as Triunfo Bet and Apuestas Royal became market leaders, capturing over 70% of the market.

Key Indicators for Venezuela:

| Blask Index | Number of Brands | Main Players |

|---|---|---|

| 29 million (94.75% growth YoY) | 130 | Triunfo Bet (51.17%), Apuestas Royal (21.27%), JuegaEnLinea (7.51%) |

Mexico: A Country with Great Potential

Mexico is showing impressive growth amid improved internet infrastructure and recent regulatory changes. In 2024, the market grew by 55.74%, reaching 51 million. With restrictions on land-based gaming machine licenses, operators are eager to explore online platforms. Major players such as Caliente and BetMexico saw strong growth.

Key Indicators for Mexico:

| Blask Index | Number of Brands | Main Players |

|---|---|---|

| 51 million (55.74% growth YoY) | 118 | Caliente (37.02%), BetMexico (12.16%), Bet365 (9.39%) |

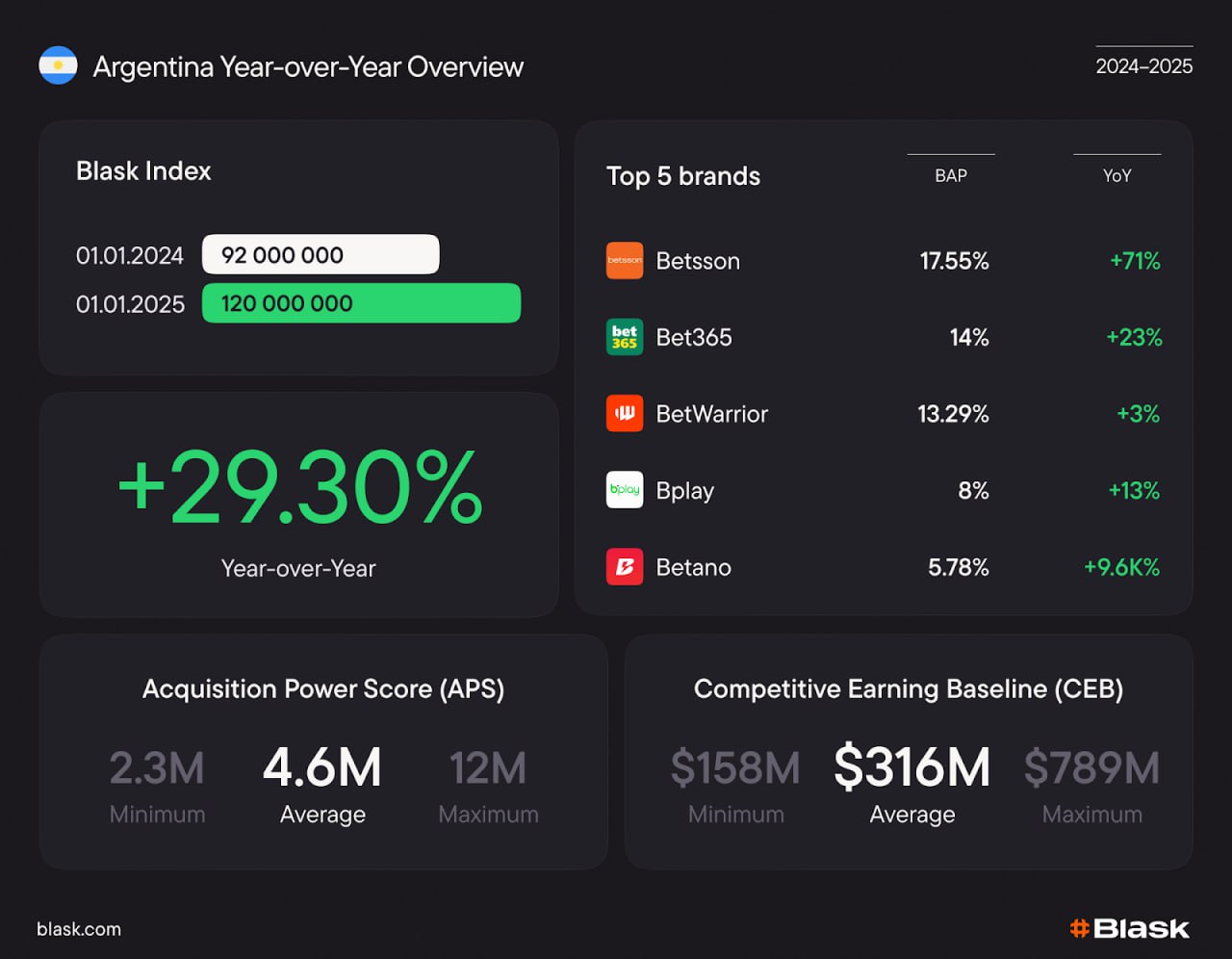

Argentina: A Market with Challenges and Potential

Argentina showed a growth rate of 29.30%, bringing the country to 120 million in the Blask Index in 2024. Despite tough regulations, such as restrictions on payment methods and efforts to combat gambling addiction, the market continues to grow. Leaders like Betsson and Bet365 maintained their positions, while Betano demonstrated an astounding 9600% growth.

Key Indicators for Argentina:

| Blask Index | Number of Brands | Main Players |

|---|---|---|

| 120 million (29.30% growth YoY) | 136 | Betsson (17.55%), Bet365 (14%), BetWarrior (13.29%) |

Overall Picture: Who Else is Leading in the Region?

Other countries in the region also show interesting growth trends. Chile grew by 23%, while Brazil, despite its huge market, increased by only 1.23%. Ecuador and Peru, on the other hand, faced declines: Ecuador’s market decreased by 2.23%, and Peru’s by 5.07%.

Key Indicators for Other Countries:

- Chile: +23% YoY, Blask Index: 54 million, Main Players: Betano (51.64%)

- Brazil: +1.23% YoY, Blask Index: 2.4 billion, Main Players: Betano (17.95%)

- Ecuador: -2.23% YoY, Blask Index: 75 million, Main Players: Ecuabet (81.77%)

- Peru: -5.07% YoY, Blask Index: 201 million, Main Players: Apuesta Total (49.80%)

Conclusion

Venezuela, Mexico, and Argentina continue to lead the iGaming market in Latin America, attracting attention from both local and international players. The development of infrastructure, as well as changes in legislation and public sentiment, create new opportunities and challenges for operators. Given the high growth dynamics in these countries, the market is expected to expand, improving conditions for the online gaming business in the future.