The iGaming Market in Chile Will Grow to $669.7 Million by 2027

Market Growth and Potential

According to research by iGamingToday, the online gambling market in Chile, currently valued at $150 million, is expected to grow at an annual rate of 9.27%. By 2027, the market size will reach $669.7 million. The sector’s development is linked to the anticipated legalization, which will create stable conditions for operators and increase tax revenues.

Key Growth Factors:

- Legalization of online gambling.

- High internet penetration (90.2%).

- Strong interest in sports betting (especially football).

- High mobile device usage (55.8% of players place bets via mobile phones).

Demographic Profile of Players

| Category | Data |

|---|---|

| Age | 70% of players are aged 21-35 |

| Gender | 55% male |

| Average Spend per Session | $90 |

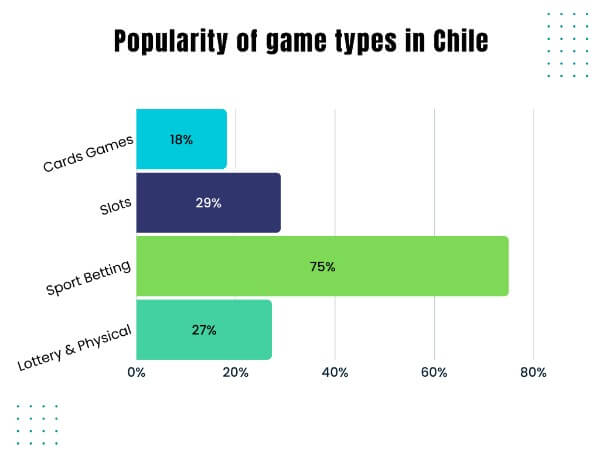

| Preferred Games | 75% – sports betting, 29.1% – slots, 18.2% – card games |

Payment Methods

| Method | Market Share |

|---|---|

| WebPay | 45% |

| PayPal | 20% |

| Credit Cards | 20% |

| Cryptocurrency | 15% |

The rise in digital payment popularity enables more convenient and faster transactions, positively impacting the industry’s growth.

Major Operators

Over 900 offshore operators currently operate in the Chilean market, but after the new law is enacted, many will receive legal licenses. Currently, the market distribution is as follows:

| Operator | Market Share |

|---|---|

| Betano | 51.64% |

| Coolbet | 9.27% |

| JugaBet | 4.69% |

| WinChile | 4.50% |

| Betsson | 4.26% |

Regulation and Taxation

In December 2023, the Chilean Chamber of Deputies approved Bill 035/2022 to legalize online gambling. The bill includes:

- Gross Gaming Revenue (GGR) tax – 20%.

- Mandatory contributions: 2% for sports and 1% for responsible gambling.

- Establishment of a new regulator – the Superintendent of Casinos and Gambling.

- 12-month transition period for “gray market” operators.

- Blocking of illegal websites and payments via ISPs and banks.

Development Prospects

With the transition to a licensed market, Chile anticipates:

- Increased tax revenues.

- Greater user trust due to better player protection.

- Entry of international operators interested in stable working conditions.

Key challenges include competition with offshore sites, the need for strict regulatory compliance, and balancing taxation. However, in the long term, Chile’s iGaming market is poised to become one of the leading markets in Latin America.