Meta Earned Billions from Rule-Violating Ads

Meta Earned Billions from Rule-Violating Ads

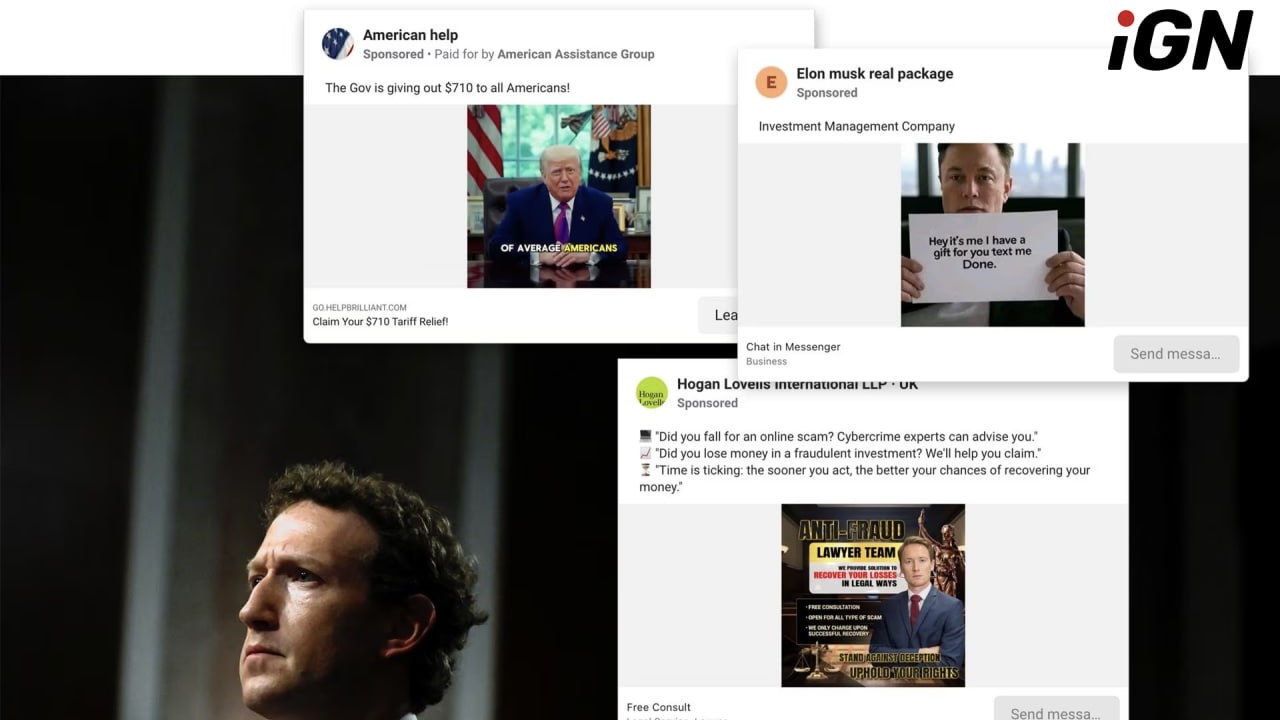

Reuters obtained internal Meta documents revealing that the company generated around $16 billion in 2024 from ads that violated its own advertising policies.

Revenue Driven by Prohibited Advertising

According to the documents, Meta projected that roughly 10% of its annual 2024 revenue would come from ads promoting scam projects, banned products, and illegal services. Internal estimates also indicate that users on Facebook, Instagram, and WhatsApp see up to 15 billion suspicious ads every day.

About $7 billion of yearly revenue comes from ads containing clear signs of fraud. On industry forums, advertisers noted that Meta remains an easy platform for promoting illegal online casinos and investment schemes.

How the Blocking System Works

The documents describe a system in which Meta bans advertisers only when there is 95% confidence that a violation is taking place. When the system detects lower—but still significant—risk, the company applies a penalty bidding mechanism: suspicious advertisers must pay higher rates until violations are fully confirmed.

- suspicious accounts are charged higher ad auction prices;

- some fraudulent campaigns remain active for months;

- advertisers may accumulate hundreds of violations before being blocked;

- large accounts can surpass 500 violations without immediate removal.

In one documented case, illegal operators spent $67 million on ads in the month before Meta finally removed their campaigns.

Scale and Regulatory Pressure

The documents show that Meta limits its spending on fraud prevention to 0.15% of revenue. Experts describe this threshold as insufficient, as its impact on Meta’s earnings is minimal.

| Category | Value |

|---|---|

| Share of revenue from violating ads | ≈ 10% ($16B) |

| Revenue from obvious scam ads | $7B per year |

| Daily scam-ad impressions | ≈ 15B per day |

| Removed ads in 2025 | 134M |

Meta’s Response

Meta called the 10% figure a “rough” estimate and claimed it includes many legitimate ads. A spokesperson added that the company is working to reduce the presence of prohibited ads and has lowered user reports of scam content by 58% over the past 18 months.

Internal Policy and Global Investigations

Documents produced between 2021 and 2025 outline how Meta evaluates revenue risks and responds to regulatory pressure. In several countries, the company faces investigations for allowing fraudulent advertising and illegal services on its platforms.

In the United Kingdom, Meta was linked to 54% of all payment-related fraud cases in 2023. In the United States, the SEC is reviewing investment-related ads on Meta platforms.

User Complaint Handling

Documents show that in 2023, Meta rejected or ignored up to 96% of valid user fraud reports. Shifting priorities and staffing cuts in safety teams reduced Meta’s ability to process complaints.

- over 100,000 valid scam reports were submitted weekly;

- most complaints remained unresolved;

- in 2024, employees created an internal “Scammiest Scammers” report highlighting the most complained-about advertisers.

Plans to Reduce Revenue from Prohibited Ads

Meta aims to reduce its share of revenue from violating ads from 10.1% in 2024 to 7.3% in 2025 and to 5.8% by 2027. However, the company acknowledges that rapid reductions could impact broader revenue forecasts.

Internal documents also show that Meta expects up to $1 billion in regulatory fines—though this is significantly less than the $3.5 billion the company earns from high-risk scam ads every six months.

Publication of the Investigation

The Reuters investigation concluded its review of Meta’s internal processes around violating ads and drew renewed attention to the scale of prohibited advertising on the company’s platforms.