Epyllion: Online Casino GGR Reaches 45% of Video Game Spending

Consulting firm Epyllion published its annual State of Video Gaming in 2026 report, consisting of 164 slides and focused on the video game industry.

The study is based on data from Circana, Sensor Tower, Eilers & Krejcik Gaming, H2 Gaming Capital, IPSOS, and other analytics platforms.

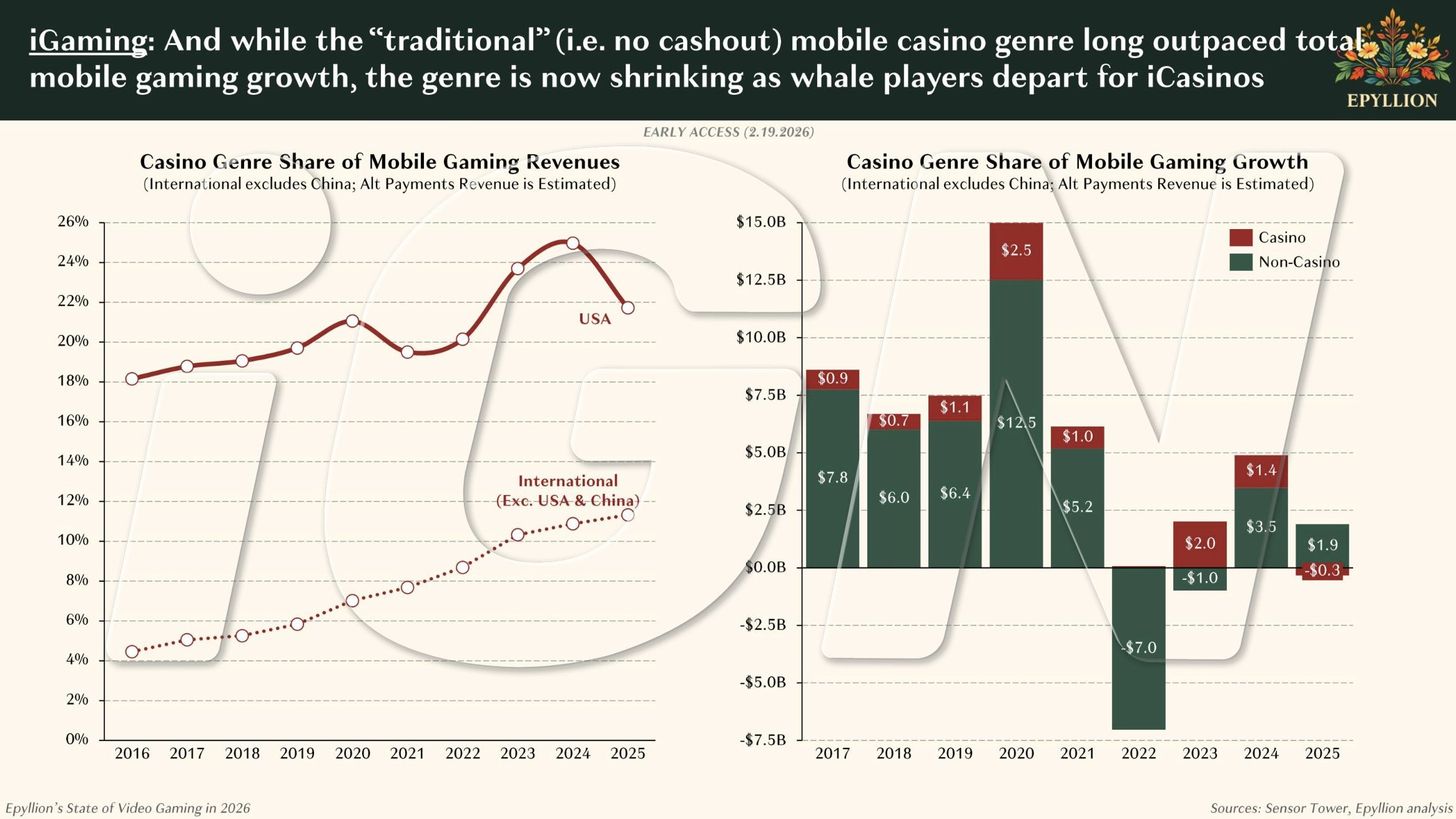

Online Gambling as a Competitor to Video Games

The report’s authors highlight online gambling as one of the main competitors for the gamer audience.

Analytics on iGaming in the report exclude illegal operators and are focused on the US market.

Key Online Casino Market Metrics

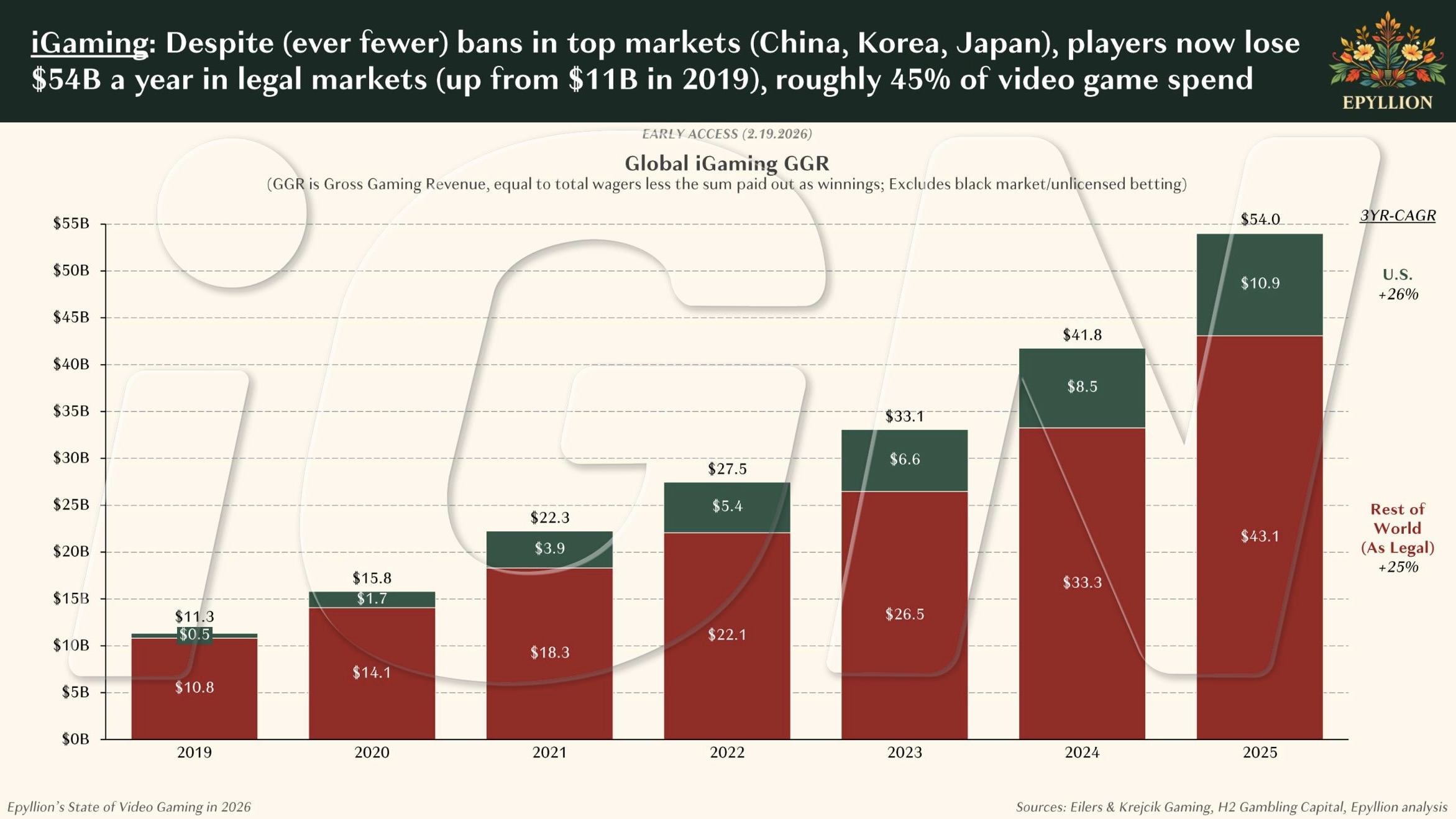

- $54 billion — global online casino GGR in 2025 ($11.3 billion in 2019).

- $53 billion — bettor losses in the online segment in 2025, including $17 billion in the US.

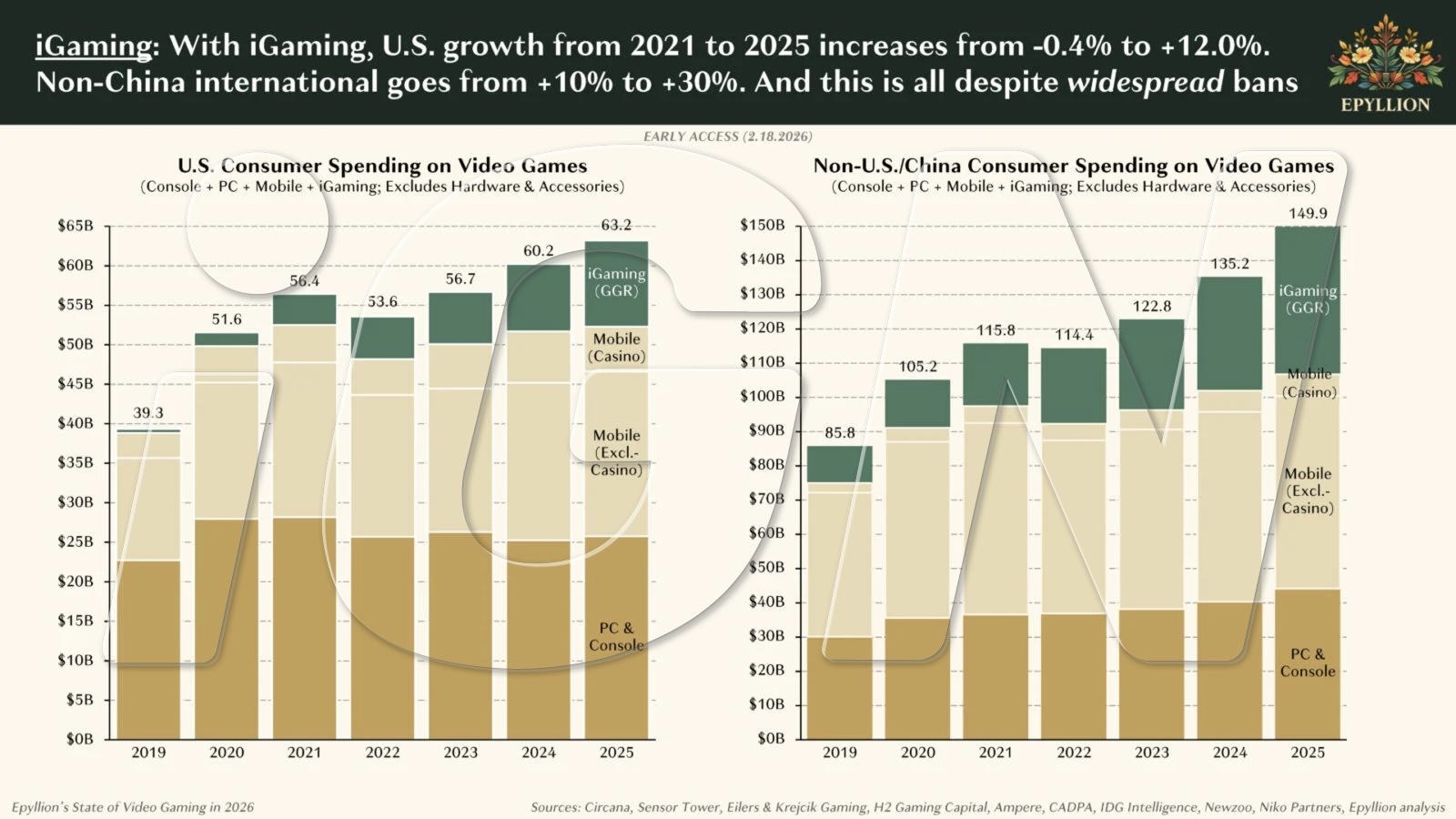

- Since 2021, US consumer spending on OnlyFans, online betting, and online casinos increased from $11.3 billion to $32.8 billion, while video game spending declined by $190 million to $52.3 billion.

Market Growth Comparison

- Including online gambling, the US video game market grew by 12% from 2021 to 2025, instead of an actual decline of 0.4%.

- In international markets excluding China, growth reached 30% instead of 10%.

Online Casinos in the US

Online casinos are legal in only 7 US states.

However, their GGR already equals 21% of video game spending and is twice the size of the social casino segment.

Online Casino GGR Structure

- 79% of GGR comes from slots.

- 19% comes from roulette, blackjack, baccarat, craps, and other games.

- 2% comes from poker.

Audience and International Markets

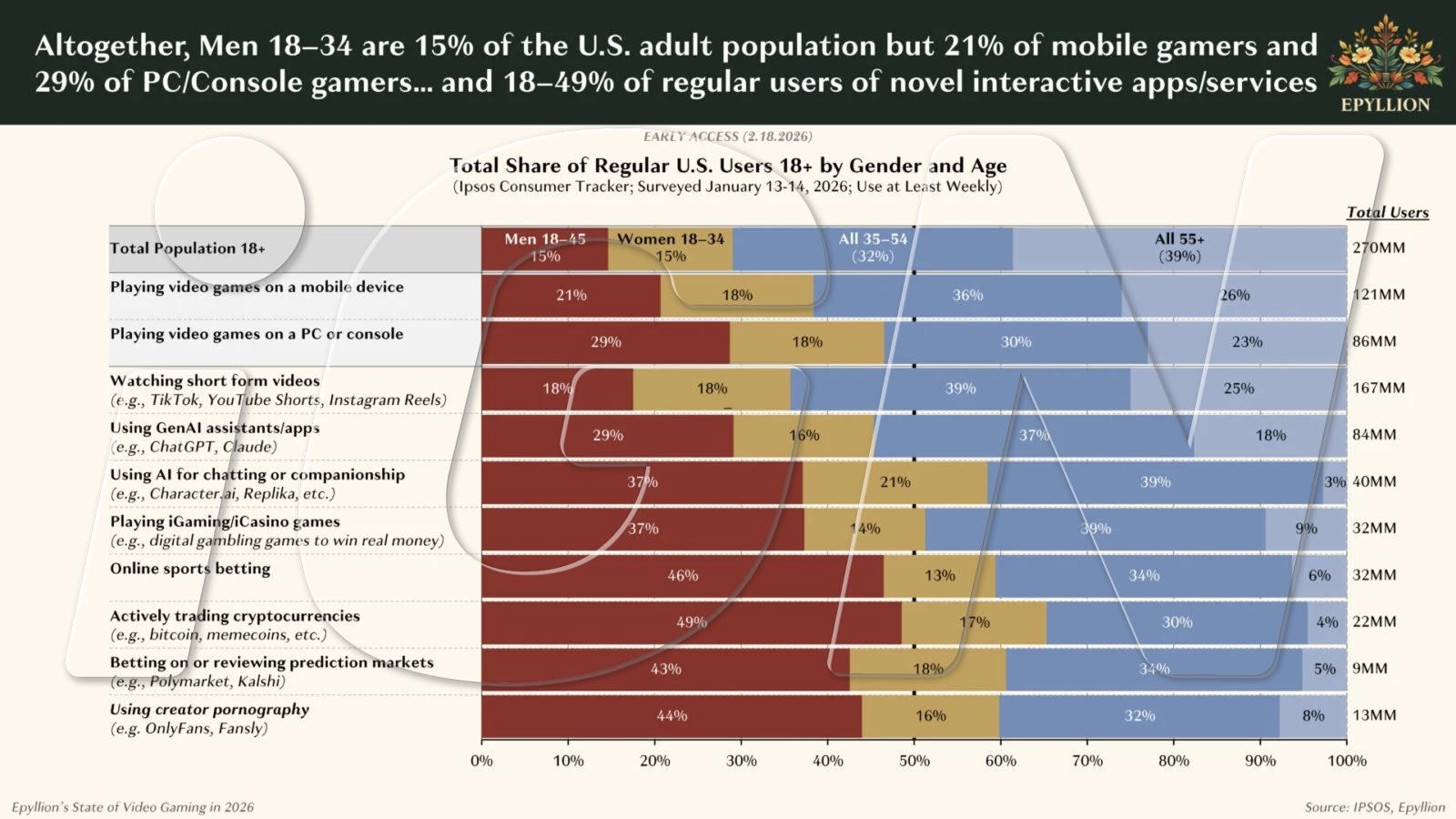

A total of 32 million Americans play online casinos and place sports bets on a weekly basis.

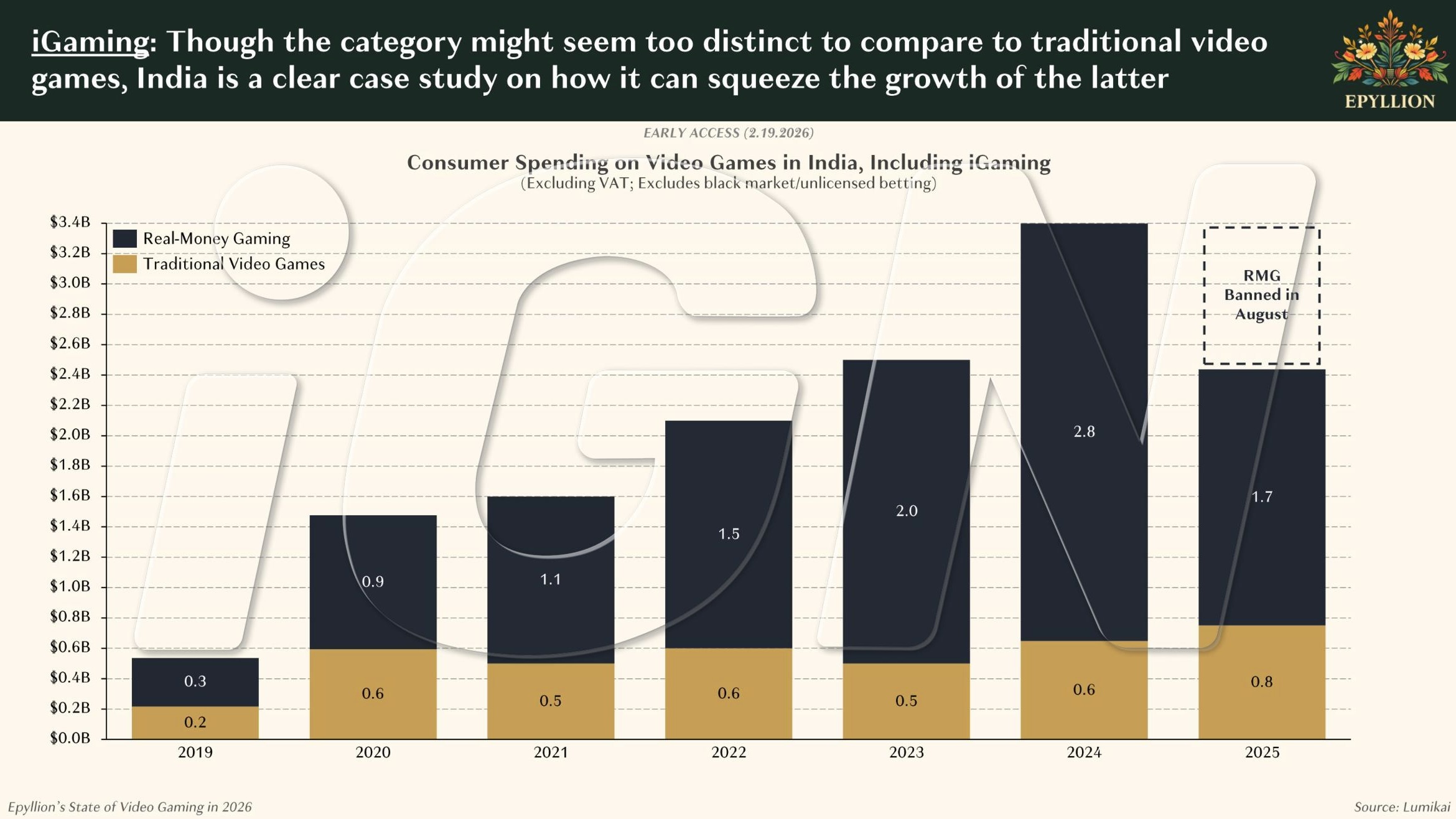

In India, spending on RMG amounted to $2.8 billion, compared to $0.6 billion on video games in 2024, before the segment was banned in August 2025.

Audience Age Structure

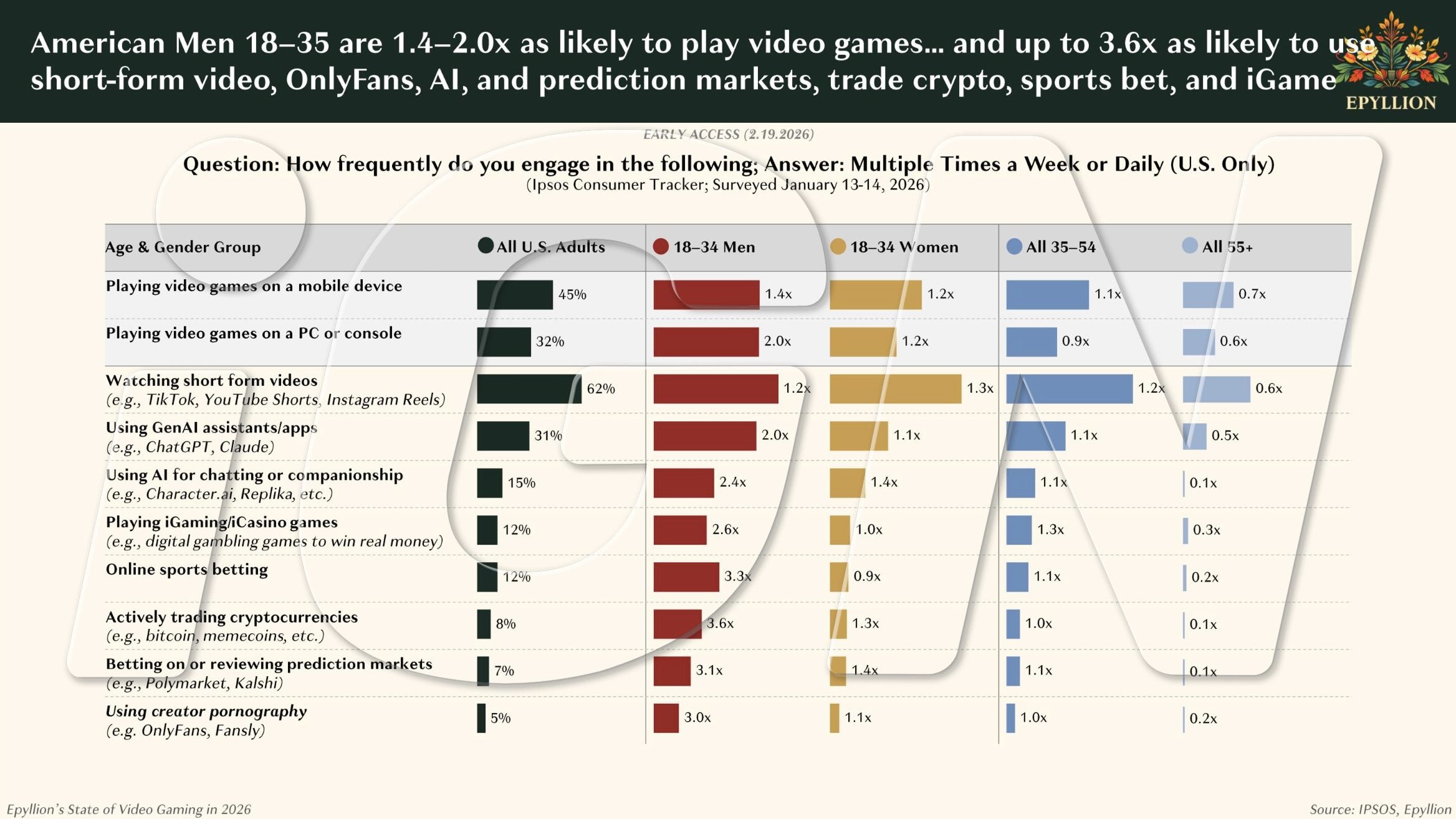

According to Epyllion, in the US the 18–45 age group remains the core of the video game market, while increasingly shifting toward online gambling.