DraftKings and Fanatics Increased Their Market Share in the U.S. Betting Industry by 20% in January

In January 2025, DraftKings and Fanatics Fanatics emerged as the leaders in market share growth in the U.S. betting industry, showing significant increases in their presence amid the overall growth of the sector. An analysis by JMP Securities revealed that these companies strengthened their positions considerably, despite differing economic conditions. As a result, both brands were able to substantially expand their share of the U.S. sports betting market.

Growth of the U.S. Betting Market

The total market volume of betting in the U.S. in January 2025 reached $1.6 billion, an 8% increase compared to the same month in 2024. Revenue from online betting increased by 9%, reaching $1.2 billion. Sports betting continued to hold a leading position, generating $900 million, an 11% increase compared to the previous year.

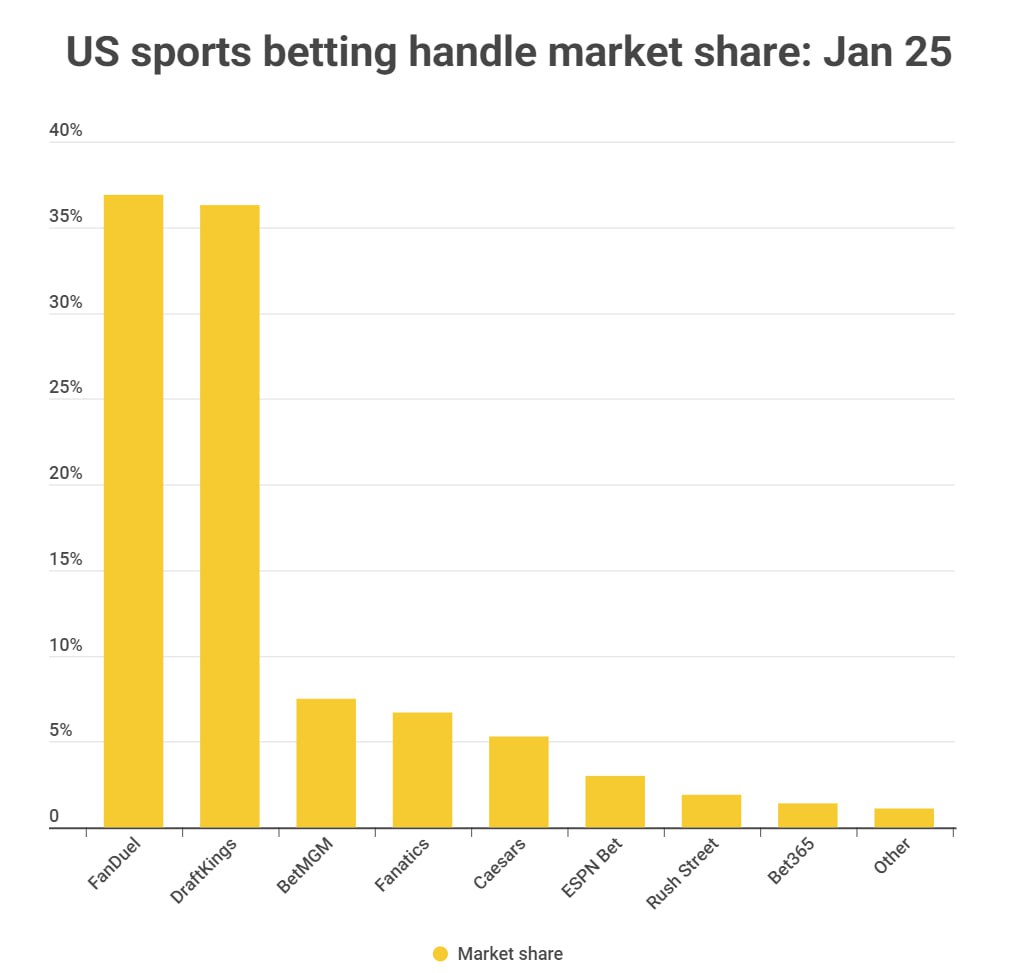

Market Share Data of Major Operators

- DraftKings: The company increased its market share to 28%, allowing it to earn $330 million in January 2025, a 14% increase compared to the same period in 2024.

- Fanatics: Showing a 22% growth compared to the previous year, the company expanded its market share to 18%, generating $220 million in revenue.

- FanDuel: Although the company continued to maintain the largest market share, its performance declined, reducing its share by 68 basis points compared to December 2024 and by 512 basis points compared to January 2024.

The combined market share of the top three operators—DraftKings, Fanatics, and FanDuel—accounted for 65% of the total U.S. betting market in January.

Promotional Strategies and Competition

Analysts note that growing competitors in the betting market, such as Fanatics, continue to capture market share, outpacing even giants like BetMGM in terms of growth. Fanatics, a relatively new player in the market, now holds a 6.7% share, closely approaching BetMGM’s performance, trailing by only 80 basis points.

It is expected that strategic changes in the marketing and promotional activities of operators may further influence market share redistribution. Specifically, DraftKings has announced plans to reduce its promotional spending in 2025.

Growth Predictions and Trends

Betting growth figures continued to rise in January 2025, despite a slowdown in the last quarter of 2024. The sports betting market is expected to accelerate in the upcoming months. Specifically, JMP analysts predict that the second quarter of 2024 will have easier comparisons than the same period in the previous year, facilitating faster growth.

Conclusion

January 2025 was a significant month for the U.S. sports betting market. Companies such as DraftKings and Fanatics continued their strong forward momentum, increasing their market share amid the overall industry growth. At the same time, market leaders such as FanDuel faced challenges, creating new opportunities for more agile and aggressive players. Given the current trends, further shifts in the competitive landscape among the largest operators are expected.