AUOGB: Ukraine’s Illegal iGaming Market Reaches Up to 53%

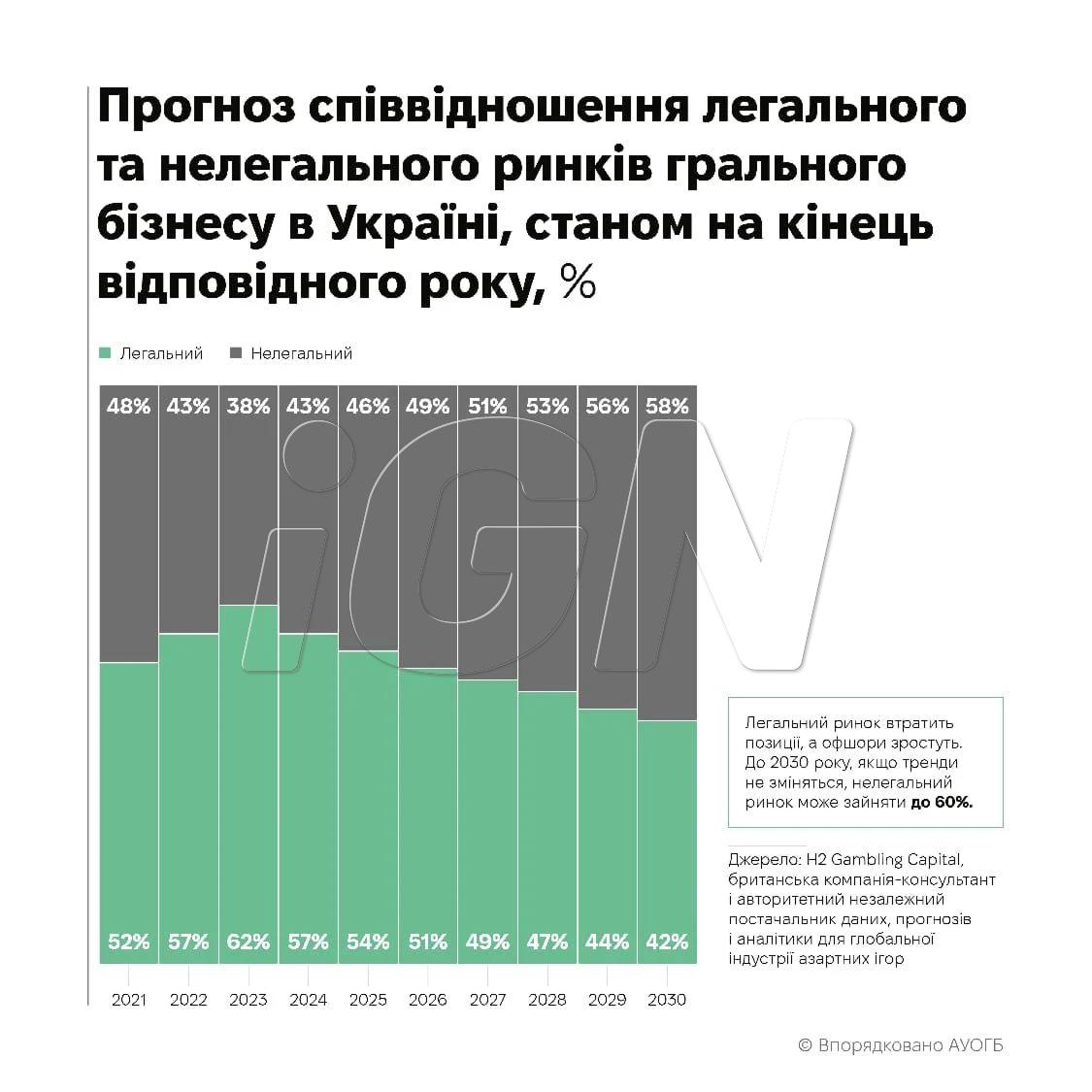

The illegal segment accounts for up to 53% of Ukraine’s iGaming market and could grow to 60% by 2030.

On February 18, Oleksandr Kohut, President of the Association of Ukrainian Gambling Business Operators (AUOGB),

gave an interview

to UNIAN, in which he presented key indicators of Ukraine’s iGaming market.

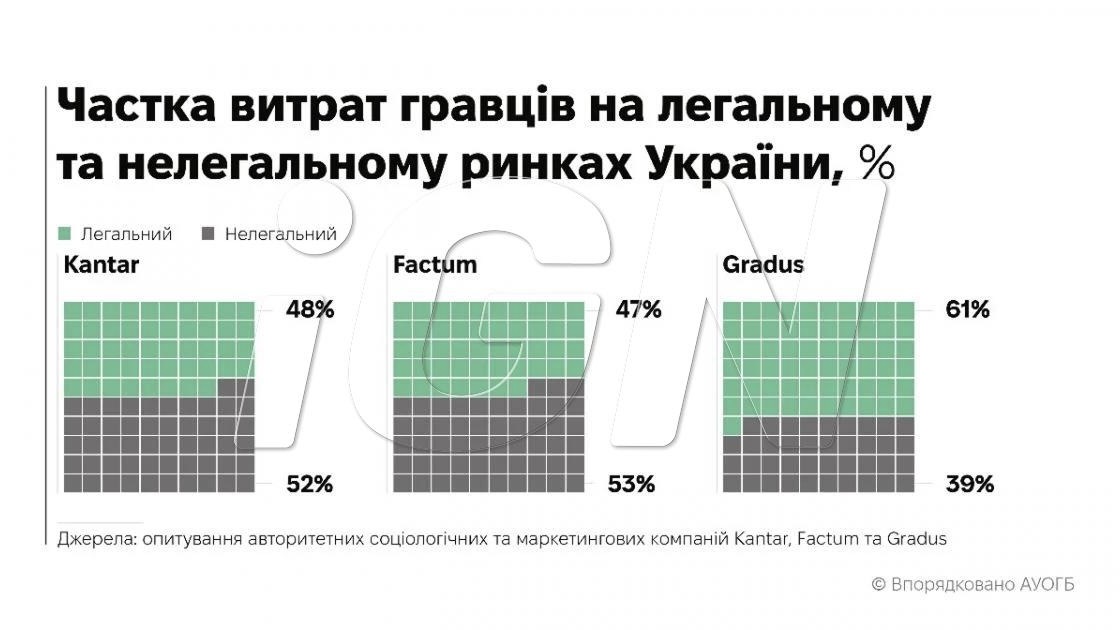

The data cited by the head of AUOGB is based on research conducted by Kantar, Gradus, and Factum,

as well as forecasts from H2 Gambling Capital.

Key Indicators of Ukraine’s iGaming Market

The iGN editorial team highlights the following figures:

- ₴100–120 billion ($2.3–2.8 billion) — total volume of Ukraine’s iGaming market;

- Approximately ₴59 billion ($1.36 billion) — revenue of the legal segment in 2025;

- ₴55–60 billion ($1.27–1.39 billion) — revenue of the illegal segment;

- 46–53% — share of the illegal segment according to Oleksandr Kohut;

- Up to 60% — projected share of the illegal segment by 2030 according to H2 Gambling Capital;

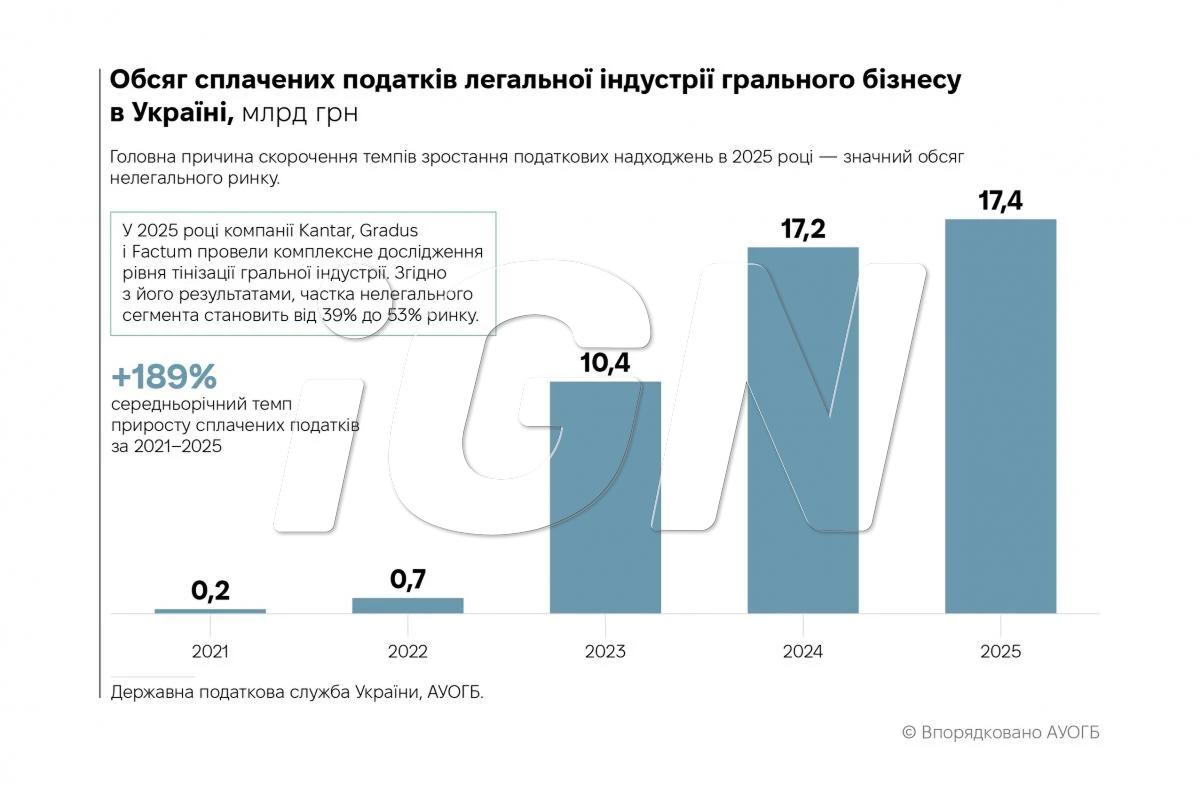

- ₴17.4 billion ($402 million) — tax revenues from the industry in 2025;

- +189% — average annual tax growth since 2021;

- 28.3% — effective tax rate for the industry;

- ₴2,426 ($56) — average player spend per week;

- About 25,000 players per quarter move from the legal segment to the illegal one.

Assessment of the Current Market Situation

According to Oleksandr Kohut, the market has reached a saturation level of ₴60 billion ($1.39 billion).

Further growth is possible only through a reduction in the share of the illegal segment.

Discrepancies in Estimates of the Illegal Segment’s Share

The iGN editorial team draws attention to discrepancies in the data.

According to AUOGB infographics citing Kantar, Gradus, and Factum,

the share of the illegal segment ranges from 47% to 61%.

At the same time, in public comments Oleksandr Kohut cited a range of

46–53%, indicating differences in calculation methodologies.