Illegal Operators Control 62% of South Africa’s iGaming Market

The South African Bookmakers’ Association (SABA), together with the South African Banking Risk Information Centre (SABRIC), published the “Yield Sec South Africa 2023/24 Report”, stating that offshore unlicensed companies control the majority of the country’s online gambling market. This poses serious risks to the economy, tax revenues, and players.

Key Market Indicators

| Indicator | Value |

|---|---|

| Share of illegal operators | 62% |

| Share of licensed operators | 38% |

| Annual economic losses | $2.9 billion / R50 billion |

| Number of unlicensed websites | 2084 |

| Players using illegal operators | 16 million (27% of population) |

Major Market Players

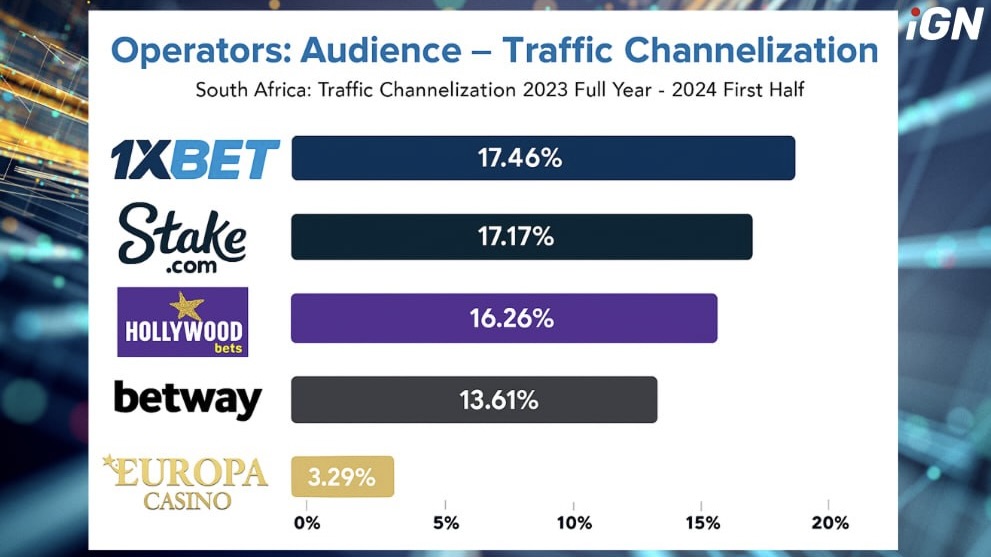

According to the report, the largest online gambling operators by traffic in 2023–2024 were:

- 1xBet — 17.46% (unlicensed)

- Stake — 17.17% (unlicensed)

- Hollywoodbets — 16.26% (licensed in South Africa)

- Betway — 13.61% (licensed in South Africa)

- Europa Casino — 3.29% (unlicensed)

SABA’s Position

SABA CEO Sean Coleman stated that illegal platforms are creating a crisis in online gambling as they pay no taxes, do not take part in responsible gambling programs, and provide no self-exclusion tools. He emphasized that every rand spent on offshore sites is money leaving the country’s economy, reducing tax revenues, jobs, and social programs.

Offshore Licenses and Legal Loopholes

Most illegal operators are registered in offshore jurisdictions — Curacao, Malta, Gibraltar, and the Philippines. They obtain “pseudo-licenses” with minimal oversight and aggressively market their services to South African players.

Illegal websites often use local payment systems — bank transfers, EFT gateways, and third-party payment services — to process transactions, despite direct prohibitions outlined in the National Gambling Act (2004).

Measures Against Illegal Operators

SABA signed a memorandum of cooperation with SABRIC and the banking sector to combat illegal transactions. The document proposes a set of measures to restrict access to unlicensed websites:

- DNS blocking, IP blocking, and geo-restrictions for users;

- Payment blocking and merchant code filtering to stop illegal transactions;

- Prosecution of illegal operators in cooperation with provincial regulators;

- Inter-agency enforcement modeled after the UK, Australia, and Finland;

- Restrictions on affiliates and influencers promoting illegal platforms;

- Public awareness campaigns to help users distinguish legal and illegal sites.

Economic Impact and Outlook

According to SABA, over R50 billion is siphoned offshore each year through unregulated gambling turnover, depriving South Africa of significant tax revenues and public investments. Meanwhile, according to the National Gambling Board, the domestic market’s total GGR reached $4.35 billion in 2024/2025 — a 26% increase from the previous year.

Experts note that the share of illegal sites continues to grow, while the licensed sector suffers losses despite overall market growth. Strengthening enforcement and blocking financial channels remain key priorities for the coming years.