Top 3 Overrated and Underrated iGaming Markets According to Blask and NEXT.io

The analytics platform Blask, in collaboration with NEXT.io, has published an analysis of the most promising and overrated markets for operators and affiliates in the iGaming space.

How the Markets Were Evaluated

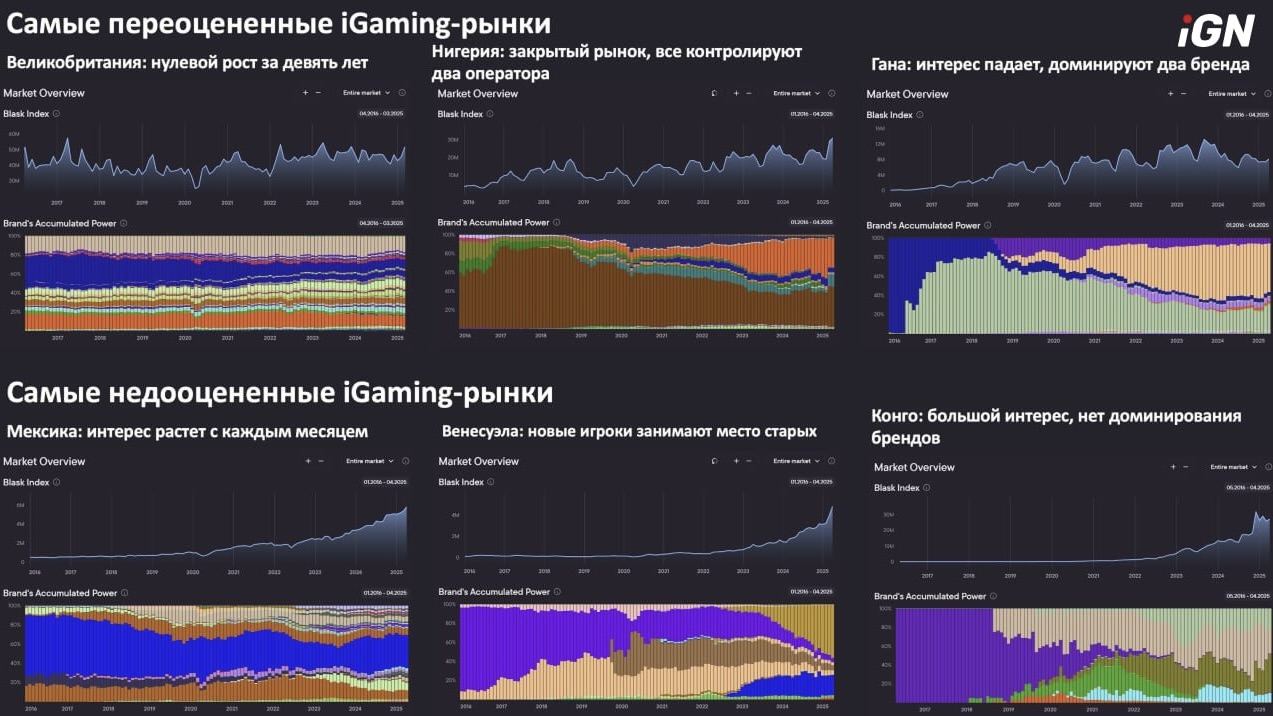

The analysis relied on the Blask Index — a real-time metric that reflects shifts in online search interest for iGaming.

It was complemented by the BAP (Brand Accumulated Power) index, which measures a brand’s market strength and ability to attract players.

Overrated markets are those where growth has stagnated and market leaders leave little room for newcomers. Underrated markets, on the other hand, show strong growth and vibrant brand competition.

Overrated Markets: Large but Closed

United Kingdom: Stability Without Growth

The Blask Index in the UK has remained stable at around 50 million from 2016 to 2025, showing no signs of growth. The BAP index is similarly stagnant—users remain loyal to established brands, while new entrants struggle to gain trust.

Nigeria: A Market Dominated by Two Giants

Since 2022, Nigeria’s Blask Index has hovered around 20 million. Market share breakdown:

- 73% — Bet9ja and SportyBet

- ~1% — 1xBet, betPawa, Betway (each)

The market is essentially “locked”; new operators can’t offer competitive value to players or affiliates.

Ghana: Declining Interest and Market Control

As of 2025, Ghana’s Blask Index sits at 8.19 million—almost half of its September 2023 peak of 13.19 million.

76% of the market is controlled by just two operators—SportyBet and Betway—leaving minimal room for new players.

Underrated Markets: Growth and Opportunity

Mexico: Open Competition Among Brands

Since 2020, interest in iGaming has been on the rise. The BAP index reveals consistent competition—no single brand has maintained dominance for long.

This creates a dynamic and open environment where new operators and affiliates can carve out their market share.

Venezuela: Leadership in Flux

Since 2022, the Venezuelan market has seen rapid changes:

- PaRLey: from 87% (2016) to 4.79% (2025)

- Triunfo Bet: has captured 50% of the market since 2022

The market remains open to fresh brands offering compelling products.

DR Congo: High Momentum and Brand Diversity

In 2025, the Blask Index in DR Congo has doubled compared to 2024. Around 30 brands are actively competing for user attention. Former leader Premier Bet has lost its dominance:

- 2017 — 100% market share

- 2025 — less than 1%

The market clearly shows signs of openness and healthy competition.

Conclusion: Bigger Doesn’t Mean Better

The study highlights a key insight: market size doesn’t guarantee opportunity. The UK, Nigeria, and Ghana are saturated, with limited room for new entrants to compete against entrenched brands.

Meanwhile, Mexico, Venezuela, and DR Congo are experiencing explosive growth and ongoing shifts in leadership—making them ideal environments for newcomers.

| Country | Blask Index | Status |

|---|---|---|

| United Kingdom | 50M (stable since 2016) | Overrated, closed market |

| Nigeria | 20M (since 2022) | Overrated, dominated by 2 brands |

| Ghana | 8.19M (down from 13.19M peak) | Overrated, shrinking market |

| Mexico | Rapid growth since 2020 | Underrated, highly competitive |

| Venezuela | Growing since 2022 | Underrated, shifting leadership |

| DR Congo | 2x YoY growth in 2025 | Underrated, 30+ competitors |

Key Takeaways

- Don’t rely on “famous” markets—they may be overrated and offer limited growth potential.

- Markets with a rising Blask Index are more likely to deliver real opportunities.