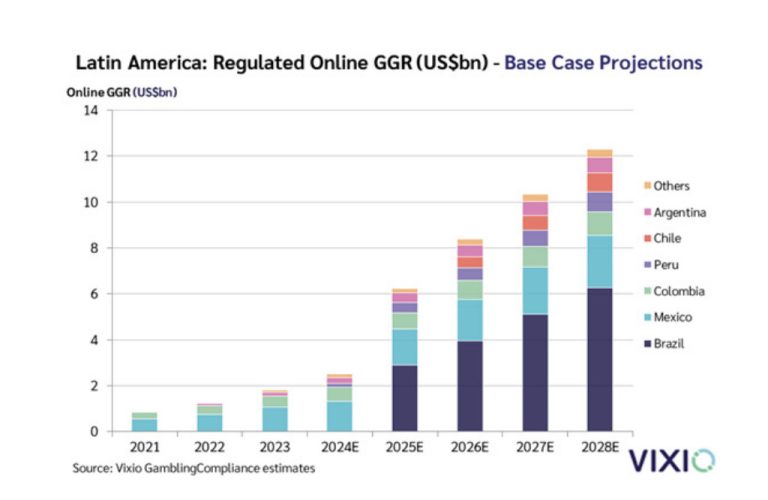

The Latin American iGaming Market to Grow Fivefold by 2028

Market Growth Outlook

According to the Vixio analytics platform, the Latin American iGaming market is projected to reach $12.3 billion by 2028, five times the size of the 2024 figure ($2.5 billion). The compound annual growth rate (CAGR) is expected to be approximately 46.77%.

Key Regional Players

Brazil — Growth Driver

On January 1, 2025, Brazil launched a regulated sports betting market, positioning the country as a regional leader. By the end of 2025, gross revenue is expected to reach $2.9 billion, representing 47% of the total regulated Latin American market. This figure is forecasted to grow to $6.3 billion by 2028.

Despite a 12% tax on gross income and the potential introduction of additional taxes (IBS and CBS), which could increase the tax burden up to 26.5%, the market remains highly attractive, with 114 applications for federal licenses already submitted.

Mexico

The Mexican market has shown steady growth and is expected to exceed $2 billion by 2028, compared to $1.3 billion in 2024. The commercial potential is further enhanced by the linkage of online licenses to land-based operators. However, regulatory challenges and legal disputes over restrictions remain significant.

Colombia

Colombia already holds a strong position in the region, and its market is set to surpass the $1 billion mark by 2028. Effective regulations have made the country one of the first in the region to establish clear rules for online gambling.

Peru

Peru is one of the most rapidly developing markets. After issuing 118 licenses to 63 operators, competition in the country has significantly increased. In 2025, the market is expected to generate $436 million in revenue, with that figure growing to $850 million by 2028.

New Opportunities and Challenges

- Argentina faces the threat of a ban on gambling advertising, which could impact market growth.

- Chile plans to introduce new licenses and regulations by 2025, making the market more attractive to investors.

- Brazil is undergoing ongoing legal discussions and potential regulatory changes, including Supreme Court deliberations.

Conclusion

Latin America is emerging as one of the fastest-growing iGaming markets in the world. Key markets such as Brazil, Mexico, Colombia, and Peru show significant potential for investors and operators. However, regulatory changes and tax policies require constant monitoring for successful business operations in the region.